Amarc is led by a dynamic management team with extraordinary depth and experience finding and advancing porphyry deposits in British Columbia (BC) and around the world.

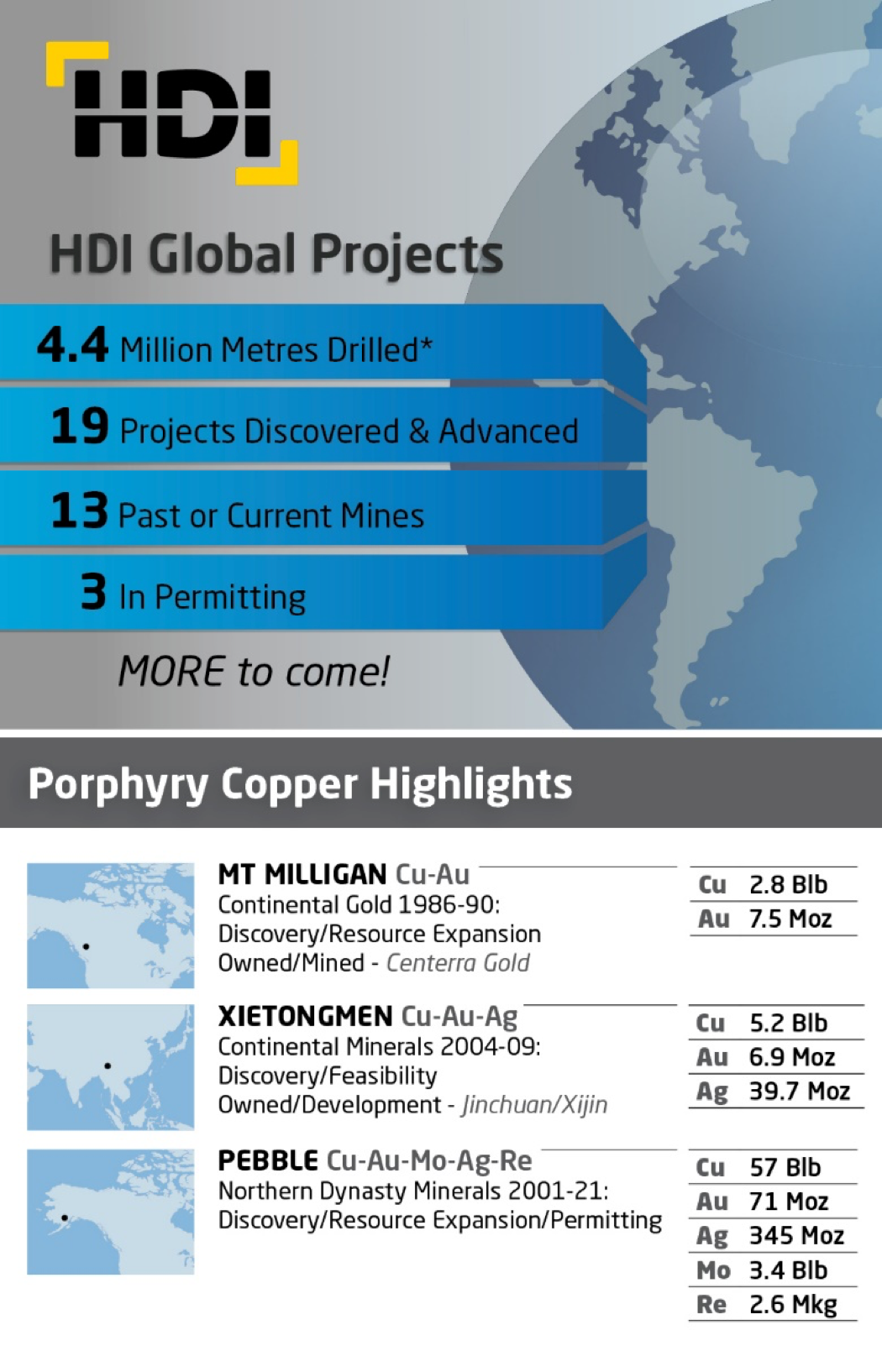

Amarc is associated with Hunter Dickinson Inc. (HDI), a company with a 35-year history of discovery, development and transaction on multiple mineral projects. Previous HDI projects include some of the world’s most important porphyry deposits, such as Mount Milligan, Kemess North and South, Gibraltar and Sisson in Canada, Pebble and Florence in the USA, and Xietongmen and Newtongmen in China. All are current or former producing mines, or late stage permitting projects.

HDI’s accomplishments derive from focused and comprehensive technical assessments, supported by strong financing and progressive development principles. Extensive community consultation, engaging local workers and employing leading-edge quality control/quality assurance programs were standard procedure at HDI long before becoming industry best practice.

HDI’s accomplishments derive from focused and comprehensive technical assessments, supported by strong financing and progressive development principles. Extensive community consultation, engaging local workers and employing leading-edge quality control/quality assurance programs were standard procedure at HDI long before becoming industry best practice.

Amarc is building on HDI’s proven global porphyry Cu success. Robert Dickinson (Executive Chair & HDI co-founder) and Mark Rebagliati (Technical Advisor) are both members of the Canadian Mining Hall of Fame, recognized for their success in discovering and developing porphyry copper deposits. President & CEO Dr. Diane Nicolson has led successful exploration teams and evaluated mineral deposits around the world, with a particular emphasis on the North and South American Cordillera.

Amarc’s principals share an innate understanding of porphyry Cu-Au deposits, and how their size and mineral composition create high value, high demand mining production. The company is committed to thorough technical assessments and careful planning that is a hallmark of all HDI companies. At each of its district-scale properties, the Amarc team has synthesized extensive historical data with results from its own, modern geological investigations to make important deposit discoveries at IKE, DUKE and JOY, as well as identifying new potential. It is clear that each project is a multi-faceted district, encompassing near and longer term development opportunities.

With its robust portfolio of three district-scale assets hosting known deposits and ten high quality deposit targets prime for advancement, Amarc is HDI’s new value vehicle for the 2020s.

Notes to Graphic:

*HDI associated companies 2.2 million metres & predecessor companies 2.2 million metres

Milligan (pre-mining): total contained metal in Meas 335Mt at 0.2% Cu, 0.4 g/t Au & Ind 372Mt at 0.17% Cu, 0.27 g/t Au (US$4.10/t NSR cutoff) Source: Terrane Metals Mount Milligan Feasibility Study 2009 Technical Report (remaining Dec 31/20) total contained metal is 1.4 Blb Cu, 3.5 Moz Au on Prov 125Mt at 0.4 g/t Au, 0.23% Cu & Prob 45Mt at 0.37 g/t Au, 0.21% Cu plus Meas 61.7Mt at 0.37 g/t Au, 0.18% Cu & Ind 63.4Mt at 0.32 g/t Au, 0.2% Cu (NSR cutoff US$7.64/t) Source: Centerra Gold website www.centerragold.com

Xietongmen: total contained metal in Xietongmen Meas 198Mt at 0.44% Cu, 0.62 g/t Au, 4.0 g/t Ag & Ind 22Mt at 0.37% Cu, 4.2 g/t Au, 2.5 g/t Au plus Newtongmen Ind 486Mt at 0.29% Cu, 0.17 g/t Au, 0.82 g/t Ag (0.15% Cu cutoff) Source: Continental Minerals 2009 Technical Report Pebble: total contained in Meas 527Mt at 0.33% Cu, 0.35 g/t Au, 178 ppm Mo, 1.7 g/t Ag, 0.32 ppm Re & Ind 5.9Bt at 0.41% Cu, 0.34 g/t Au, 246 ppm Mo, 1.7 g/t Ag, 0.42 ppm Re (0.3% CuEQ cutoff; metal prices Cu US$1.85/lb, Au US$902/oz, Mo US$12.250/lb) Source: Northern Dynasty 2020 Technical Report